What is Bitcoin?

Bitcoin (BTC) is a decentralized digital currency, that operates independently of central banks or government control. It is designed to be used as a medium of exchange and is rewarded to users who verify transactions on the blockchain network. It can be purchased on various online exchanges and was first introduced to the public in 2009 by an anonymous developer or group of developers using the pseudonym Satoshi Nakamoto. Bitcoin has gained widespread recognition and has inspired the creation of other cryptocurrencies, some of which aim to improve upon its features or utilize it in other blockchain-based applications.

The creator of Bitcoin

The creator of Bitcoin, known by the pseudonym Satoshi Nakamoto, is an anonymous individual or group of individuals who first published the Bitcoin white paper in 2008. The identity of the person or people behind this pseudonym remains unknown, and despite various attempts to uncover their true identity, the mystery remains unsolved. Satoshi Nakamoto is estimated to own around 1 million Bitcoin, which at current value would make them one of the wealthiest people in the world. In 2011, Satoshi Nakamoto handed over the control of the source code repository and network alert key to Gavin Andresen, a computer scientist and one of the earliest Bitcoin contributors, and subsequently disappeared from the public eye.

Basic Understanding of Bitcoin

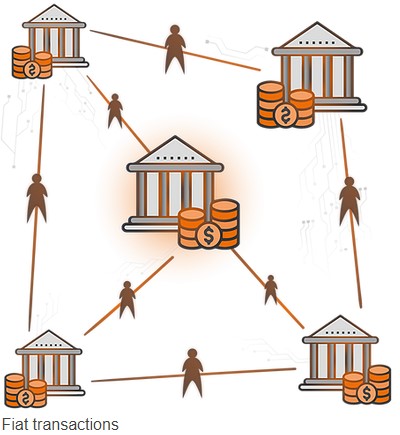

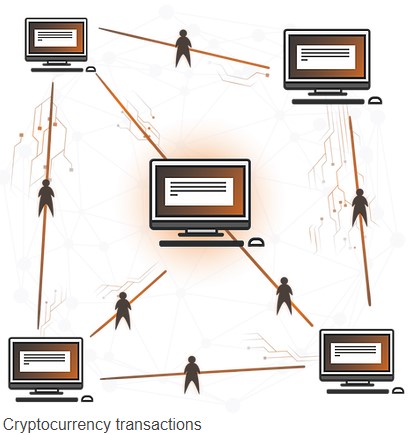

Understanding Bitcoin can be challenging for those who are new to the concept. At its core, Bitcoin is a digital currency that operates on a decentralized, peer-to-peer network. This means that it is not controlled by any central authority, such as a government or bank, and transactions can be made directly between individuals without the need for intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a decentralized network of computers. These computers, called nodes, use complex algorithms to verify and process transactions, and are rewarded with newly minted Bitcoins for their work. This process is called mining.

Another important aspect of Bitcoin is its finite supply. There will only ever be 21 million Bitcoins in existence, and as of January 2021, over 18.7 million have been mined. This scarcity, along with increasing demand for the currency, has led to its volatility in value.

One of the major advantages of Bitcoin is its security and anonymity. Transactions are secured using advanced cryptography and the blockchain ensures that once a transaction is recorded, it cannot be altered or deleted. Additionally, users can remain anonymous when making transactions, as personal information is not linked to a Bitcoin address.

However, it is important to note that Bitcoin is still a relatively new technology and its regulatory and legal status is still evolving in many countries. As a result, it is important to stay informed and exercise caution when investing in or using Bitcoin.

Blockchain Technology

Bitcoin’s blockchain technology is a decentralized, digital ledger that records all transactions made on the Bitcoin network. It is called a “blockchain” because it consists of a chain of blocks, each containing a group of transactions.

Each block in the blockchain is linked to the previous one through the use of complex cryptographic algorithms, creating an unbreakable chain of blocks. This is what makes the blockchain so secure and resistant to tampering.

Once a block is added to the blockchain, the information it contains is permanent and cannot be altered. This ensures that all transactions are accurate and transparent, and eliminates the need for intermediaries such as banks to verify transactions.

The blockchain is maintained by a network of computers, called nodes, that work together to verify and process transactions. These nodes are incentivized to participate in the network by being rewarded with newly minted Bitcoins. This process is called mining.

The blockchain technology has many potential uses beyond Bitcoin, such as in supply chain management, digital voting systems, and smart contracts. Due to its transparency, immutability and decentralization, blockchain technology has the potential to revolutionize various industries.

It is important to note that the blockchain is an open source technology and various other projects have implemented it to create their own decentralized platforms and currencies like Ethereum, Litecoin and many more.

Bitcoin Mining

Bitcoin mining is the process by which new Bitcoins are created and transactions on the Bitcoin network are verified. The process is accomplished through the use of powerful computer hardware, specifically designed to perform complex mathematical calculations.

Miners, who are individuals or organizations, use their computing power to solve complex mathematical problems that are part of the process of creating new blocks on the blockchain. When a miner successfully solves a problem, they are rewarded with a certain number of newly minted Bitcoins and the block is added to the blockchain.

The process of Bitcoin mining is also responsible for verifying transactions on the Bitcoin network. When a user initiates a transaction, it is broadcast to the network and picked up by miners. Miners then use their computing power to verify the transaction by solving complex mathematical problems. Once a transaction is verified, it is added to the next block that is mined and becomes a permanent part of the blockchain.

As the number of miners on the network increases and the amount of Bitcoin in circulation grows, the difficulty of the mathematical problems that need to be solved also increases, making mining more complex and resource-intensive.

Bitcoin mining is becoming increasingly competitive as the number of miners on the network grows and the difficulty of mining increases, so a significant investment in hardware and electricity is required to stay profitable. It’s also important to note that mining is a power-intensive process, and it has environmental implications as well.

The Uses of Bitcoin

Bitcoin is primarily used as a digital currency for online transactions and as a store of value.

As a digital currency, Bitcoin can be used to make purchases online, in person, or at physical locations that accept it as a form of payment. Bitcoin can also be used to make online or offline payments to individuals or businesses, without the need for intermediaries such as banks. This makes it a useful option for people in countries where traditional banking systems are not well-developed or for those who want to keep their financial transactions private.

In addition to being used as a medium of exchange, Bitcoin is also used as a store of value. It is decentralized, meaning that it is not controlled by any government or institution, which makes it immune to inflationary pressures. Some people see it as an alternative to traditional investments such as stocks and gold.

Bitcoin can also be used as a form of investment. Due to the limited supply of Bitcoin, and the increasing demand for it, the value of Bitcoin can be volatile. Some investors buy Bitcoin with the expectation that its value will increase over time, and then sell it at a profit.

Furthermore, Bitcoin can be used for various other purposes as well like for remittance, for micropayments, for online gambling, for charity and many more.

It’s important to keep in mind that Bitcoin transactions are irreversible, and it’s important to be cautious when making transactions, particularly with strangers or unfamiliar entities. Additionally, as Bitcoin is not regulated and its value can fluctuate widely, it is considered a high-risk investment, and investors should exercise caution when investing in it.

The Risks of Investing in Bitcoin

Investing in Bitcoin carries a high level of risk due to its volatility and lack of regulation.

One of the main risks of investing in Bitcoin is its volatility. The value of Bitcoin can fluctuate wildly in a short period of time, making it a risky investment. This volatility can result in large losses for investors who are not well-versed in the market and do not have a long-term investment strategy.

Another risk of investing in Bitcoin is its lack of regulation. Bitcoin is not backed by any government or institution, and there is little oversight of the market. This means that there is a higher chance of fraud and market manipulation, which can lead to significant losses for investors.

Furthermore, there’s a risk of hacking and theft. As Bitcoin transactions are recorded on a public ledger, it is possible for hackers to access the private keys to a user’s Bitcoin wallet and steal their funds. Additionally, there have been incidents of hacking or theft at Bitcoin exchanges, where large amounts of Bitcoin have been stolen.

Another risk is that the usage of Bitcoin is not widely accepted, thus limiting the places where you can use it as a currency, this can make it difficult for Bitcoin holders to find places to spend it and make it less useful as a medium of exchange.

Lastly, it’s important to note that Bitcoin is still a relatively new technology and its regulatory and legal status is still evolving in many countries, which can make it difficult to invest in Bitcoin with confidence.

Overall, it’s crucial to understand the risks involved before investing in Bitcoin and to invest only what you can afford to lose. As with any investment, it’s important to do your own research, understand the market, and have a long-term investment strategy in place.

Bottom Line

Bitcoin is the first decentralized digital currency that was introduced in 2009. It operates independently of central banks or government control, and is intended to be used as a medium of exchange. Since its launch, Bitcoin’s popularity has grown and it has become the most well-known cryptocurrency in the world. This has resulted in the creation of many other cryptocurrencies that aim to either improve upon its features or utilize it in other blockchain-based applications.

Investing in Bitcoin is relatively simple, as it can be purchased on various online exchanges. However, it is important to note that investing in Bitcoin carries a high level of risk due to its volatility and lack of regulation. Investors should consider their financial situation and risk tolerance before investing in Bitcoin, and it’s always recommended to consult with a financial advisor before making any financial decisions. Additionally, investing in Bitcoin should be treated as a high-risk speculation and any investments made should be done with caution and only with money that you can afford to lose.

Disclaimer

BitcoinCzechia offers guidance for selecting reliable crypto exchanges. We solely focus on offering visitors a clear insight into the best exchanges. We do not offer any financial advice concerning the crypto trading tips. Our website is an educational platform that offers detailed reviews of the top three exchanges in the Czechia Republic.

Please note that we do receive an affiliate commission for advertising exchanges and digital wallets pertaining to crypto trading. We utilize the funds earned for the development of the crypto community.